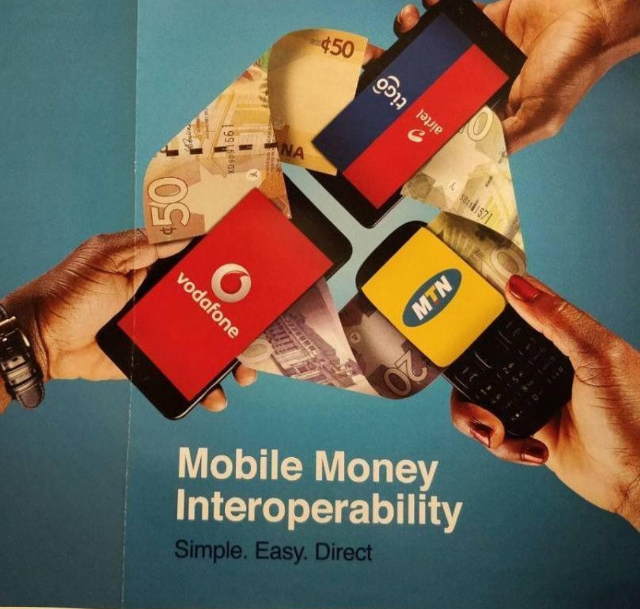

Ghana has rolled out the second phase of an ongoing reform within its mobile money services sector. It is called the Mobile Money Interoperability platform.

The interoperability platform is to allow for seamless flow of transactions across mobile money, bank and other payment systems.

This means it should be possible to send money from one mobile money wallet to any electronic payment platforms such the local ‘E-zwich’ card.

The completion of the second phase, implies that the mobile money platform, e-zwich and bank accounts are all interconnected, allowing for free flow of funds across all three platforms.

This major breakthrough is expected to help businesses and create convenience, as payments across the country can take place in real time, from any part of the country.

It will also contribute significantly to the country’s cash-lite agenda. The first phase of the programme was launched by Ghana’s Vice President Dr Mahamadu Bawumia in May this year.

Ghana’s Information Minister Kojo Oppong Nkrumah says “ the completion of the Financial Inclusion Triangle had made Ghana one of the few countries in Africa to achieve the Universal Interoperability, ensuring connecting of bank accounts, MoMo wallet and ezwich, thereby allowing a seamless flow of financial transactions´.

Mr Nkrumah says “Since its roll out in May, it has recorded about 1.3 million transactions valued 134 million cedis”.

Mobile money has become the most used platform for business transactions across Africa.

Source: Africafeeds.com